the Case is updated.

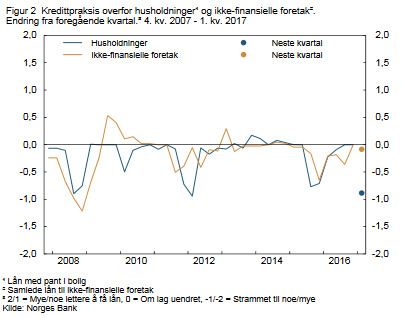

In the fourth quarter higher demand for loans from households slightly, while the demand for loans from enterprises was unchanged, shows Norges Bank’s survey of bank lending.

Utlånsmarginene on loans to households fell slightly, while they increased slightly for the enterprises.

For the current quarter alerts banks ‘ låneinnstramming for households.

Banks reporting that they would tighten the credit standards for households in the first quarter of 2017 as a result of the changes in the boliglånsforskriften, according to the survey.

the Regulation, which came into force from 1. January, involves, among other things, that the customer’s total loans shall not exceed five times the gross income, while buyers of second homes in Oslo must have 40 per cent equity to get loans.

In the rest of the country is the requirement of 15 per cent continuing.

According to the survey, almost all of the banks given the changes in the boliglånsforskriften as the cause for mitigation.

Banks reported that they will tighten in on the conditions that determines the maximum debt in relation to income, maximum debt to boligverdi and the use of the interest-only period.

Norges Bank’s lending survey helps to shed light on changes in the demand and supply of credit for households and businesses.

In addition, queried about changes in banks ‘ loan terms for households and businesses.

Banks asked to consider the last quarter compared with the preceding quarter. They are also asked to consider the expected development in the next quarter compared with the last.

The nine largest banks in the Norwegian market to participate in the survey.

Source: Norges Bank

No comments:

Post a Comment