Global oil investments has fallen sharply since 2014.

But in the years they can turn, think analyseselskapet Wood Mackenzie.

the Company believes global oljeselskapers investments in exploration and development will increase by three per cent to 450 billion dollars (3.875 billion) in 2017, compared with the year before.

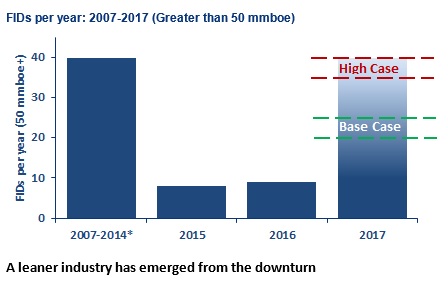

Also, the number of new oil and gassutbygginger which are decided globally is likely to double from last year to this year, think the company.

– The global investeringssyklusen will show the first signs of growth in 2017, and ends thus a devastating two-year decline in investment, says Malcolm Dickson, Wood Mackenzies leading analyst within the upstream oil and gas production.

oil Companies have adopted only nine major developments in 2016, but this figure will rise to more than 20 years, predicts he.

Many of the developments are smaller and simpler than gigantprosjektene that was set in motion in the period before 2014, when oil prices were above $ 100 barrel for several years.

So oljebremsen in 2017.

– the Companies will get more bang for your buck, says Dickson.

– This is partly a result of the moving the capital away from the complex megaprosjekter to the smaller, step-by-step expansion projects in the canadian oil sands and in deep water, ” he says.

Down 40 percent

This is not, however, a notice of that golden age in the oil industry is on full speed back.

Investment is still 40 per cent below the level in 2014, and the number of developments in the year is far below the average of 40 per year in the period between 2010 and 2014, according to Wood Mackenzie.

Malcolm Dickson, oljeanalytiker in Wood Mackenzie

the Costs in the oil industry will continue to fall through 2017, while companies continue to slim down, believes Wood Mackenzie.

This rhyme also with Statoil chief Eldar Sætres statement this month that the realignment in the Norwegian oil industry will continue in 2017.

Read more: How oljebremsen in 2017

Good news for the Uk

One of the good news for Norway is that dypvannsprosjekter come back, according to Wood Mackenzies recent report “Five things to watch in 2017″.

the Industry has selected the best projects that they want to optimize and continue with. In 2017 it will have to focus their attention on the next wave of investment to make them ready for a decision, ” says Dickson.

RETURNS: In the years to come the oil companies to adopt more projects than in the past two years, predicts Wood Mackenzie. The graph shows the investment in the projects of over 50 million barrels of oil equivalent in the last ten years, with projections for 2017.

the Report stresses, however, that several dypvannsprosjekter have a challenging economy. Of the 40 major projects in the deep water that has not yet been decided, will half struggle to achieve an internal rate of return of 15 per cent at an oil price of 60 dollars a barrel.

internal rate of return is often used by oil companies as a measure of a project’s rate of return, and can be used to compare the profitability between different projects.

The new oljeministeren about the big energispørsmålene

Statoil’s very profitable Johan Sverdrup field has a calculated internal rate of return of 23 percent, according to a previous assessment by Wood Mackenzie.

to improve profitability is required to continue cost-cutting in a number of projects, believes the company.

– In better shape

After several years of significant cost-cutting has many oil companies have managed to make the developments profitable at much lower oil prices than a few years ago.

Among other things, Statoil has cut costs in fields that have not yet been decided so that they in average are profitable at 41 dollars a barrel, while the same fields needed a price of 70 dollars a barrel in 2013.

The weather contributes to the price spikes of natural gas in Europe

On the Johan Castberg field in the Barents sea Statoil has dropped oil pipeline and terminal on the country and halved the development costs, so that the project is profitable with an oil price down toward $ 40 per barrel.

Such dramatic reductions in costs and a sharp improvement during their commercial producing profitability is a consistent theme in the industry, believes Wood Mackenzie.

2017 is going to demonstrate how effective the oil and gas industry has been, and view the projects evenly over the are in better shape, ” says Dickson.

the Case continues below the advertisement.

see also: 440.131 oljejobber has gone global

Think the united STATES increases the

IN the united STATES have oil producers been particularly effective in cutting costs, and that is where the recovery will be strongest in years, think Dickson.

There has been a dramatic increase in efficiency in the sector, as represented by borelagene which now completes wells up to 30 percent faster, he says.

the Investments in the production of shale oil is likely to increase by 23 percent from last year to this year, to 61 billion dollars, believes Wood Mackenzie. Many of these resources need low oil prices to be profitable, and production can quickly be scaled up.

Oljeåret – from 27 to 57 dollars

Increased united STATES production

last year produced the united STATES 8.9 million barrels of oil per day. In a recent report predicts the United states energienhet EIA, production will increase to 9 million barrels per day this year and 9.3 million barrels per day in 2018.

at the same time expect the EIA the price of Brent oil will remain at 53 dollars a barrel on average in the year and 56 per barrel on average next year.

the Cost in the United states oljebransje can come to begin to increase again in 2017, if the activity takes up a lot of up, believes Wood Mackenzie. But the company believes that this will be compensated for by increased efficiency in older oljeregioner in the united STATES, where boretempoet still can be increased a lot, believes the company.

No comments:

Post a Comment