the main index ended the day at 623,08 Thursday, after an increase of 2,24%.

Shares and primary capital certificates were traded for 4.274 million.

Wall Street opened slightly down, in the wake of the joyful jobbtall, GDP growth met expectations, and a smaller trade deficit than expected.

A half hour after opening got investors on the other hand served the disappointing numbers for boligsalget.

Leading European stock exchanges drew for the most part also up.

British FTSE 100 ended up one percent, the French CAC 40 and 0.3 per cent, while the German DAX fell 0.3 per cent.

Red in the Burned after rally

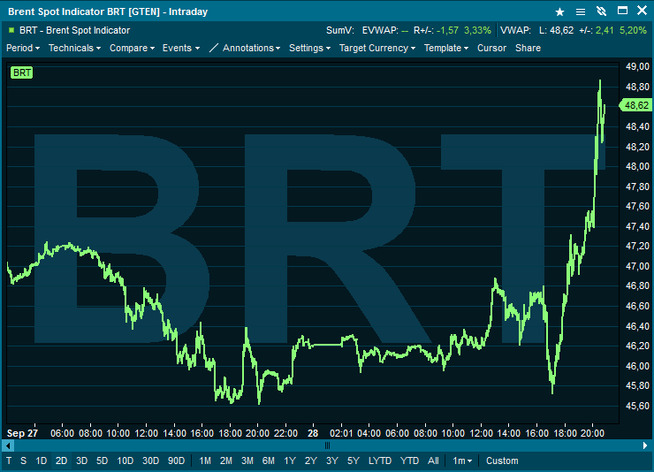

The good mood intertwined with the powerful oljeprisoppgangen triggered by OPEC signals yesterday evening. OPEC members should agree about a need to cut oil production by 240.000-740.000 barrels per day, it will say to 32,5-33,0 million barrels per day.

the Signals sent oil prices straight up, and Brent november oil was up in 49,50 dollar at the highest in yesterday’s trading.

Frontkontrakten correct albeit down 0.2 per cent to 48,59 dollars a barrel in today’s trading, but is less than one dollar above the levels at the close in Oslo yesterday.

WTI oil was up in 47,43 per barrel at the highest yesterday, and in today’s trading up 0.1 per cent to 47,12 per barrel.

- OPEC playing dangerous

But the uncertainty is still large. How the cut is allocated, shall not be decided before the OPECs next meeting 30. november.

According to Saudi Arabia’s oil minister shall not Nigeria, Iran and Libya are the subject of the cuts, as long as they keep production at a “meaningful level”. (…) As we know from earlier, similar to this a lot of the problems with the financing of fellesgoder. All have the interest that it be cut, but for the individual, it is of course best to produce the most possible, write DNB Markets in a comment.

- If some land should be protected, other countries take more. The incentive to cheat when he refused the first is established, is also strong. With some other words: We believe it when we see it, they add to.

analysis supervisor for raw materials in the SEB, Bjarne Schieldrop, believe OPEC is playing a dangerous condition.

” We believe OPEC is playing a dangerous game if the goal is to push oil prices higher in the short term, since it will only initiate more skiferoljeproduksjon in the united STATES. It will make it difficult for OPEC to place the potentially-cut volumes back in the market at a later date, he writes in an update.

Schieldrop believes OPEC still have a headache: what to do if the volumes from Libya and Nigeria take up again?

- Who should cut their production to make space for them? What looks clear to us, is that it does not become plankekjøring from OPEC from here, even though they have now managed to achieve an internal agreement, enter analysesjefen.

Hefty Statoil-rise

no Matter: the increase in oil prices had a very positive influence on the Oslo stock Exchange.

Statoil rose by around 6.9% (8,70 million) to 134 million. Oljekjempens market value is the most out with over 28 billion, and total market value is now up to around 430 billion.

Further advanced The Norwegian 5.5 per cent to 120 million, while DNO la on 5,7%, to 8,18 money. TDN Finans show Thursday afternoon to a message from Gulf Keystone, which says that a judge in London has approved the agreement on the restructuring of the debt of the company.

the Bondholders in Gulf Keystone will, according to the Bloomberg own 85,5 per cent after the restructuring.

At the end of July let DNO place a bid on all new share capital in Gulf Keystone for 300 million dollars, after the latter’s refinancing. Then the chairman of the board Bijan Mossavar-Rahmani said in mid-august that the company was hoping for a response from the shareholders and bondholders in the first half of september.

Seadrill, which rose 20 percent in the U.S. yesterday, popping up around 32,9% to 20,50 money.

PGS excelled with an increase of 10.6 per cent of 17,58 million, while Songa Offshore also rose double-digit – 10.5 percent to 21 cents.

Subsea 7 climbed 4.8 per cent to 85,55 money on the day where it hung Statoil-praise for the Aasta Hansteen job. Aker Solutions and TGS ended up respectively. 5.5% to 37,88 million and 5.4 percent to 146,60 money.

Among the heavyweights, incidentally, we highlight the us REC Silicon on the plus 10.9 per cent to 1.05 million.

DNB step 3.3 percent to 106,70 money. The banking sector stood out positively in the united STATES yesterday at the reduced uncertainty around the Deutsche Bank, after the sale of an insurance business and the release of 1.2 billion dollars.

On the negative side fell Reciprocal 0.6 per cent to 148,10 money after Nordea according to TDN Finans downgraded the stock from buy to hold, while Salmar, Hydro, Yara and the Norwegian ended the day down less than one percent.

Sol both up and down

Relatively speaking, mixed Navamedic into among oljeservicevinnerne with an increase of 10.3 per cent to 13,45 million.

We take with Avance Gas on the plus 9.9 percent to 20 million, while it has not yet restructured supplyrederiet Havilah Shipping rose 9.0 per cent to 1,69 million.

Scatec Solar went up 4.4 per cent to 30,60 money on a Nordea-analysis.

Q-Free has implemented a directed share issue that was overtegnet several times. The stock rose 6.5 per cent to 8,06 million. Wednesday’s message that the company is close to a deal in the united STATES came in grevens time.

Taperlisten topped by Kitron, which fell 10.6 percent to 5,50 money after storeier folded and cashed in on the stock still is up over 110 per cent in the last 12 months.

the Sale of the kjempeposten brought the turnover in the stock up in 311 million. Only Statoil, DNB and Marine Harvest were more traded.

Closest to the Kitron followed EAM Solar at minus 8.2 per cent to 34,80 money and Emas Offshore, which went back of 6.9 per cent to 54 cents.

We also take with Link Mobility Group, which fell 2.5 per cent to 159 million after having carried out a targeted and significant overtegnet share issue of nok 100 million (of course 150 million).