Norges Bank gave in connection with the rentemøtet Thursday “monetary policy report 2017″, where they point out the most important things for the Norwegian economy next year.

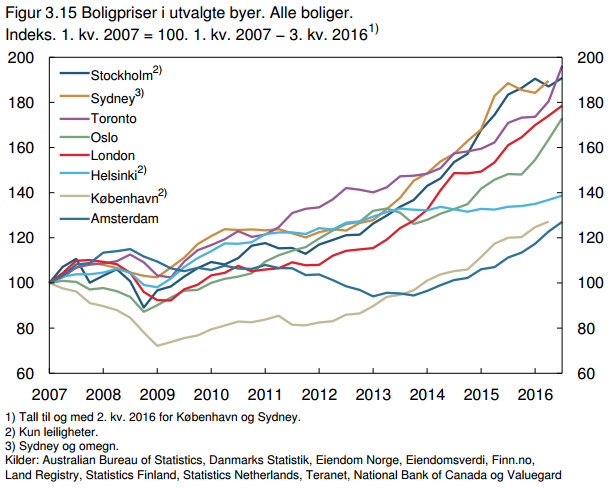

They have looked at house prices – and which brought in numbers from several other major cities in the world.

the Figures show that none of the selected cities have had the same wild boligprisøkning that Oslo in the last year.

From the beginning of January in the year until the end of september rose by house prices in the capital with 16,82 per cent.

For comparison, the prices of apartments in Stockholm has increased by 2,39 per cent, and Helsinki with 3,43 per cent so far this year. Stockholm was also a prisversting until the government introduced more stringent requirements.

Fell during the financial crisis

Look at the time from 2007 and beyond was the house prices in Oslo at its lowest in the wake of the financial crisis in the fourth quarter of 2008.

The same tendency is seen also in several of the other selected cities.

in the Spring of 2010 were the prices for the first time over the 2007 level, and since then, have house prices risen by 10.4 per cent on average each year.

10 YEARS: the following Table shows the development in house prices in selected cities since the first quarter of 2007 and up to the end of september 2016.

Toronto with the highest growth rate

Of the table one can read that it is Toronto that is the city that has had the largest increase in the period, with a rise in house prices of 96,13%.

during the first nine months of this year rose prices in the canadian city by 13,22 percent.

Large increase in residential construction

But it is first and foremost after the summer growth has come. In the three-month period from July through september rose the prices with 8,73 per cent.

Jason Mercer, director of market analysis at the Toronto Real Estate Board tells E24 that there are several reasons behind the huge growth.

A relatively strong labour market and low vacancy in Toronto and the surrounding area has meant that consumer confidence is high in many households, ” says Mercer.

– The strong growth in the region has also helped so that Toronto is the “top-of-mind” for people who arrive in Canada for the first time, and in addition to this, home buyers benefited from the historically low borrowing costs, although these recent times have risen somewhat, ” he says.

Mercer explains that the housing market in the city in recent years has come in a vicious circle where people refuse to sell, and rather choose to redecorate.

One of the main problems is the strong demand seen up against a limited supply of homes for sale, ” he says.

It has been taken political steps to calm down the market, but Mercer believes that it is not sufficient to solve the boligproblematikken.

– Agents want solid fees, but at least possible job

– The political initiatives that have been taken have focused on reducing the demand, but the only sustainable way to get balance in the market, will be open to the larger supply of housing.

Mustermann in Toronto

Norwegian Jon Worren who works for the innovation cluster, MaRS Discovery District in Toronto tells E24 that in Canada as in the Uk’s culture of owning their own home rather than to rent, despite the fact that they do not have incentives that make it so beneficial to own as in Norway.

Although he moved to Canada in 2004, and after having rented the first six years, he bought an apartment in the city centre of Toronto in 2010.

Since then, house prices in the city rose by over 71 percent.

– the Problem with government is that they don’t have the whole overview of what drives the market, which makes it difficult to carry out precise intervention to curb the growth, ” he says.

He believes there are three main causes of the unprecedented growth in house prices: Immigration, limited land and large foreign investments.

Canadian property been seen as a “safe haven” especially among the rich chinese. This was the reason that Vancouver in august of this year introduced a 15 percent boligskatt for foreign homebuyers, according to The Wall Street Journal.

Professor reject the drastic boliglånhopp: Predicts low interest rates for a long time

the Measure has worked, and in november, falling house prices in the city for the second month in a row, writing Business Vancouver.

the Case continues below the advertisement.

Building height

Siv Jensen announced this week that it will be introduced a egenkapitalkrav of 40 per cent for sekundærboliger in Oslo.

In Toronto has it for the last 10 years was about to customize on the reguleringssiden from oslo.

– They have said that if there are lands within the city limits to be developed as they have preferred to adapt the dense population. In the last 10 years, there are no cities in North America that has had several high-rise buildings under construction, ” says Worren.

Norwegian has previously been resident in the Oslo area, and he is surprised that it is not also built high-rise buildings in Oslo, norway.

– It seems to be an aversion to building in height, it seemed I strange. When you have a policy where one wants to maintain markagrensen then one must build in the height, ” he says.

Swedish boligbrems

a Look at the tiårsveksten have also Stockholm had a higher growth in house prices than Oslo. Since 2007 prices have risen by 90,79 per cent, with the peak year in 2015 as prices in the Swedish capital rises with 18,55 per cent, according to figures from Norges Bank.

But this year, arrow turned, and in may, the Swedish capital’s largest

boligprisfallsiden the financial crisis.

the Reason that the market in Sweden has calmed down is the innskjerpede lånekravene that was introduced 1. June (see information below).

1) No one can borrow more than 85 per cent of the home’s value.

2**) Loan of 70 per cent or more of the home’s value, it must be returned at least two per cent of the entire loan each year.

3**) By a loan equivalent to 50-70 percent of the home’s value, it must be repaid at least one percent of the entire loan each year.

4) Newly-built homes is not within the scope of the requirements until after five years.

5) for example, Are you langtidssykmeldt or unemployed, can the banks make temporary exceptions from the nedbetalingskravet.

6) the Property must verdijusteres every five years or when it undergoes a “material change”.

**the New requirements introduced 1. June

Source: Dagens Industri/Finansinspektionen

No comments:

Post a Comment