the Model gets the bank’s analysts to scratch their heads.

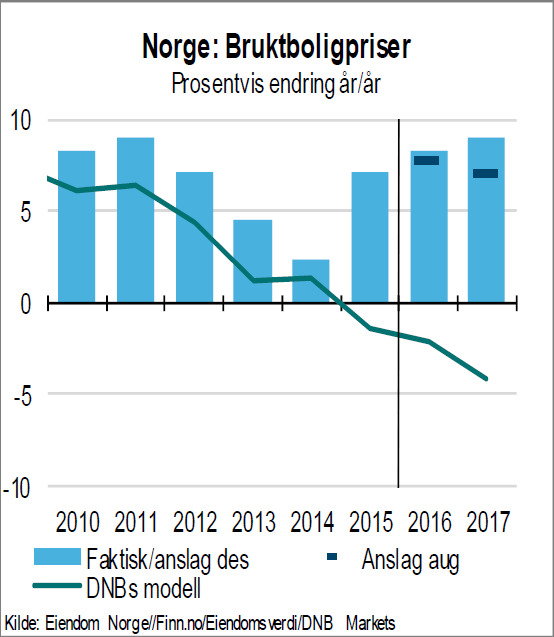

Since 2010 the systematically undervalued house prices, and 2015 went completely their own way.

While house prices in fact have risen sharply, believes the model that the prices should have fallen.

In 2017 predicts the model that the fall is even greater.

Forventningsdrevet price increases

Makroøkonom Jeanette Power Ebb explains that the historically low level of interest rates is one of the reasons. The interest rate affects the house prices in a different way than the model assumes, among other things, because we expect that interest rates will remain low for a long time to come.

But the truth is also that DNBs analysts do not fully understand why the model misses so powerful.

– It has not missed consistently over time in the past. So even if we believe that it is the interest rate, and we also believe the underestimate of the labor market, we are not sure about this. That model is so “off”, means that we are considering the extra strong if it is a forventningsdrevet rise in prices we see, ” says high Tide to the E24.

– What does it mean?

– It means that inflation is not necessarily due to fundamentals such as low interest rates, low unemployment and high income growth, but that it is due to expectations of further rise in prices in itself. It’s what many define as a bubble, ” says Ebb.

MODELLBOM: From 2015 dive the model down, while house prices go up.

Muted growth in 2017.

DNB Markets, la on Tuesday, forward his calculations and predictions for how the Norwegian and international economy will look like in 2017. The housing market was one of the themes in the report.

According to the DNB will boligprisveksten intransigence in 2017, probably in the first quarter. Månedsveksten will fall from the current level of around one per cent to 0.3 or 0.4 per cent, think high Tide.

Increased residential construction is one of the reasons.

We see that residential construction responds to the sharp rise in prices. It takes time before it turns into the prices, but we believe the construction will help to curb inflation ahead, said low Tide during the presentation.

The new regulation of mortgages that are out at the hearing, drawn up as a reason.

– It is difficult to say exactly what that is adopted, but we have done a little calculation that gives a slight, but not dramatic, decline in boligprisveksten, said the Ebb.

– How secure are you on your estimates?

– Estimates are always very uncertain, and it is these boligprisanslagene also. Now that we no longer can support us just as much on the model of our, we are even more uncertain than usual.

increasing boliglånsavdrag

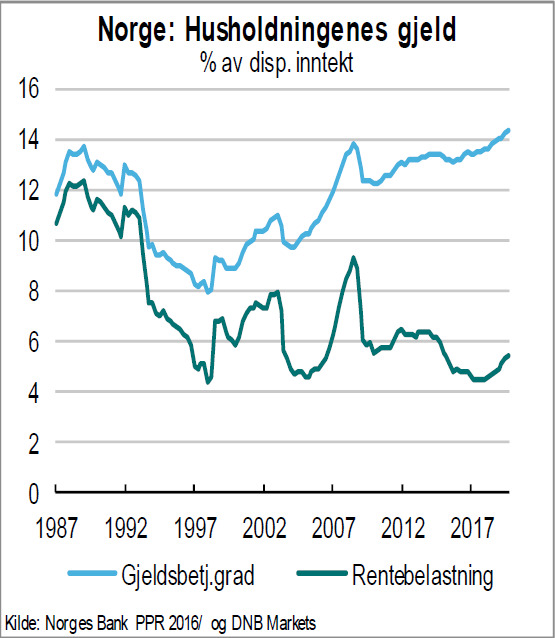

During the presentation, presented the low Tide also an overview of how much interest and repayments on people’s mortgages pose of the revenue.

despite today’s historically low interest rates poses boliglånskostnadene the same amount of revenue as before the banking crisis in 1987 and the financial crisis in 2008.

– Rentenes share of income is really not very high. There are installments that are so large. And it’s not because we have begun to pay down the loans so vastly much faster, but because we have so much debt, explains the low Tide.

– What happens if interest rates rise?

Households are very vulnerable to an increase in interest rates when you have such high debt. You have like very high housing wealth, but a renteoppgang can go together with a fall in house prices. Suddenly you just sit there and feel that one has much less money because the property has fallen quite a lot in value at the same time as even more of your income is tied up to pay instalments and interest, ” says Ebb.

such A scenario can have a negative effect on the Norwegian economy.

Historically, one sees that there are quite a few who defaults on boliglånet his. But you can get pretty powerful cuts in the consumption of other goods, and it will give a negative contribution to growth in the Norwegian economy. We will also see a decline in housing investment, which has helped to push up growth, says makroøkonomen.

LARGE INSTALLMENT: Boliglånskostnadenes proportion of people’s income is as high today as before the financial crisis in 2008 and the banking crisis in 1987 (blue line). At the same time, the interest burden on the revenue to be very low (green line).

No comments:

Post a Comment