her salary to Ålesund-the man means that the oil service company believes he is worth well 425.000 nok day in the job as chairman of the board and chief executive officer, according to DN.

It is 17.700 million in wages, or 295 million in a minute, if you will.

Since 2013, Pål Kibsgaard namely earned $ 650 million as chief executive officer of the company, a position he has held since 2011.

It comes forward of the reporting sent to the american børstilsynet the Securities and Exchange Commission (SEC), as the E24 also has seen. Where does it say that Kibsgård made 18,6 million dollars in 2016.

The best paid licence

Kibsgaard has been with the company for 20 years.

most expect he as the world’s best paid doe.

Helge Lund to become an advisor in pe firm Clayton Dubilier & amp; Rice

The rigid wage level to management has now become a theme among the shareholders, and Schlumberger will change’s from 2017, writes Dagens Næringsliv on Friday.

the Company has for the last years taken extensive cost-saving grip, and an unknown number of Schlumberger employees have lost their jobs in Norway.

While toppsjefen has gone into the hundreds of millions the last few years, the company has made approximately 50,000 employees go since 2014.

the Company has around 100,000 employees in 85 countries.

Lund could have earned more

High wages are not uncommon in the oil and gas industry.

When Helge Lund was president and ceo of gasskonsernet BG Group from 2014, was lønnspotensialet at 28 million pounds, or 292 million annually, according to the FT.

FORMER STATOIL CHIEF: Lund

It represents a day’s wage of around 800.000 nok. Lund dismissed the calculation as “useriøst”.

BG Group was right after Lund’s employment, acquired by Shell, and he is no longer the ceo.

Helge Lund is sitting in the day even in the board of directors of Schlumberger.

He is however not in lønnskomiteen in the board of directors, and thus have not determined his compatriot Kibsgaards massive gasje.

schlumberger’s board of directors has hired the consulting firm of Pay Governance LLC to assist with determining the belønningsordninger and levels.

Climbed the ranks

Before he became supreme leader, had Kibsgaard several different positions in Schlumberger, according to Forbes.

(the case continues under the picture.)

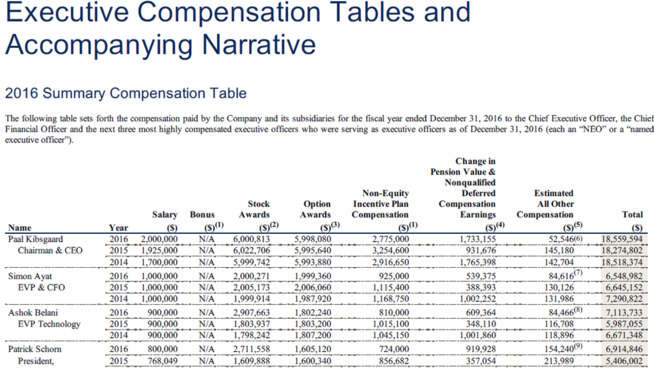

LØNNSTABELLEN: Faksimilen shows payments to Schlumberger management, as reported to the american børsmyndighetene the SEC.

Sunnmøringen have master of science-education from the petroleumslinjen at NTNU in Trondheim, and began his career in ExxonMobil in 1992.

Since 1997, he has been in Schlumberger, where he first began as brønningeniør in Saudi Arabia.

In connection with the Kibsgaard became supreme leader of the oljeservicegiganten six years ago, said the Norwegian Tore Sanvold, who had been sitting in the Schlumberger board of directors for a number of years, the following DN:

– Paul is an extraordinarily competent person. He is strong academically, and have a very great understanding of the customers ‘ reality and the needs of customers. Moreover, he is an outstanding leader.

the Year before he replaced Andrew Gould as chief executive officer worked sunnmøringen as the company’s technical director, chief operating officer (COO).

Schlumberger is the world’s largest oil service company. They have their main offices in Paris, the Hague and Texas, and according to Dagbladet lived Kibsgaard in Paris when he got toppsjefjobben in 2011.

- Share on Facebook

- Share on LinkedIn

Share on Twitter

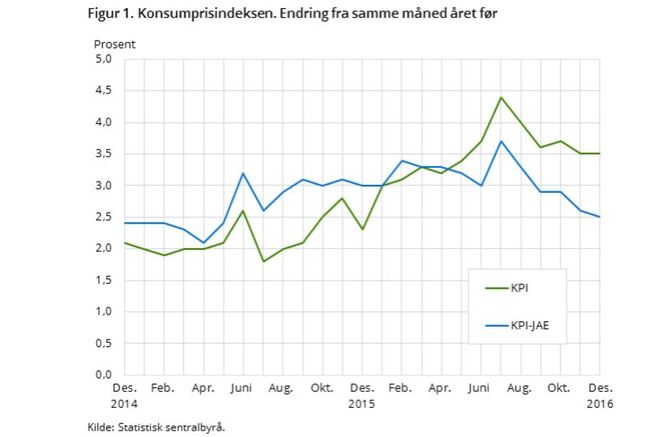

the Graph is taken from statistics norway’s inflation report for January. It shows the evolution in the consumer price index (in green) and core inflation (in green, adjusted for energy prices and tax changes) since December 2014.

the Graph is taken from statistics norway’s inflation report for January. It shows the evolution in the consumer price index (in green) and core inflation (in green, adjusted for energy prices and tax changes) since December 2014.