Oil service veteran and investor Berge G. Larsen is acquitted of Gulating High Court in what is referred to as Norway’s most extensive economic criminal.

“There is a far more than just arbitrary or theoretical doubt, and the majority do not dare look away from the explanation that the defendant has given the court of Appeal and proof the situation in light of this, is correct, “said the ruling.

it was only during the court of Appeal treatment Larsens version arrived. Larsen has not previously given statements to the police or explained in court.

Age 63

Title: Petroleum and riggründer

Background: Have the last 25 years been a familiar figure in the Norwegian oil and gas industry . Took over the job after his father, rig pioneer Bernhard Larsen, Odfjell Drilling in 1989. It was to be the start of a turbulent oil career. Had at most control of four public drilling contractors and oil company DNO. So unraveled Empire. Rigg initiative collapsed in three of Norway’s largest bankruptcies with a total unpaid debt of nine billion. Remains a modest man with an estimated fortune of several hundred million. Over the last ten years has been under investigation by the police in Bergen in what is one of Norway’s most extensive economic crimes. Fighting against both the IRS and the police. The dispute is about an alleged hidden overseas assets in tax havens Jersey and the British Virgin Islands.

Current Frikjent of Gulating High Court on Wednesday.

See more

Larsen was accused of financial fraud, tax evasion and for having provided incorrect or incomplete illumination of his fortune. Towards the end of the trial let the prosecutor the claim that Larsen had to be sentenced to five years in prison, of which 2.5 years could gjløres conditionally with a trial period of two years and a fine of three million.

Moreover believed prosecutors that Larsen had to forfeiture of 28,298,751 kroner, and that he would cover the costs of three million. Thus it’s not.

Do prosecutor mixes

The judgment – which is 61 pages – are not unanimous. One of Court of Appeal shall dissented for all items in the indictment, while one of the lay judges thought Larsen should be judged for that part of the indictment referred infidelity associated with sales of a million DNO shares.

The prosecutor argued in court that Larsen had far greater stakes in companies than he entered. Here came the court majority that the prosecutor has mixed between an owner formal management and a strong leader or entrepreneur decision exercise. The court rejected that Larsen’s power was an indication that the other shareholders in reality were straw men.

“He (Larsen, ed. Note) occurs in many ways” as if he owned the company “- but this does not result in his formal ownership position change,” it says.

Since Larsen was acquitted of adultery from the sale of DNO shares, concludes the court that it is not proven that there has been a tax evasion related to the same.

Both appealed

Larsen is one of the pioneers in the Norwegian oil and gas industry, first as CEO of Odfjell Drilling, since as head of his own business.

Bergen district court, he was two years ago was sentenced to prison for five years, half of which were suspended, for having hidden one foreign fortune of around 700 million using straw men, committed financial fraud and gross tax fraud.

- Berge G. Larsen was in 2013 found guilty of Bergen District Court in gross misappropriation of funds and gross tax fraud .

- He allegedly hidden one foreign capital had reached 700 million over a period of ten years.

- the sentence is five years’ imprisonment, of which 2.5 year unconditional and a fine of three million plus legal costs.

- Gulating Court of appeal started an appeal hearing of the case in October last year. Today is an frikjennelsesdom.

more

Both parties appealed the judgment. Larsen regard assessment of the evidence in the question of guilt and the prosecution appealed because Larsen had been acquitted of one of the record of the charges.

Not proven

Gulating High Court believes that it is not proven beyond reasonable doubt that there has been misappropriation of funds related to the company Independent Oil Tools (IOT), states the judgment.

When it comes indictment 1b, sales of one million DNO shares, believes the majority of court of Appeal judges that there is reasonable doubt about the actual deed content and Larsen therefore acquitted of this part of the indictment.

attorney Jan-Inge Raanes together with attorney Elisabeth Deinboll and police solicitor Kari Bjørkhaug Trones led case against Larsen.

Raanes was just after the clock 14 heading into a meeting to review the verdict and did not want to give any comment to DN before he has read the legal ruling.

Sufficient information

In addition to accusations of misappropriation of funds and evasion of fortune, said prosecutor that Berge G. Larsen had given incomplete information about their overseas shares of tax returns for the years 1997 to 2007 was not the court agrees. the court points out that the requirement is that the information provided should be sufficient that the IRS can ask questions or request further information.

“for the period 1997-2002, it is common that in reality for those fiscal years in the tax return is enlightened about the shares defendants owned in foreign companies, the number and par, “said the ruling. Judges thus comes to that Larsen had given sufficient information.

For the years 2003-2007 the Court that the information that was given was either insufficient or that the defendant subjectively fulfilled illumination duty and that he therefore can not be judged for tax evasion .

Dissolves structure

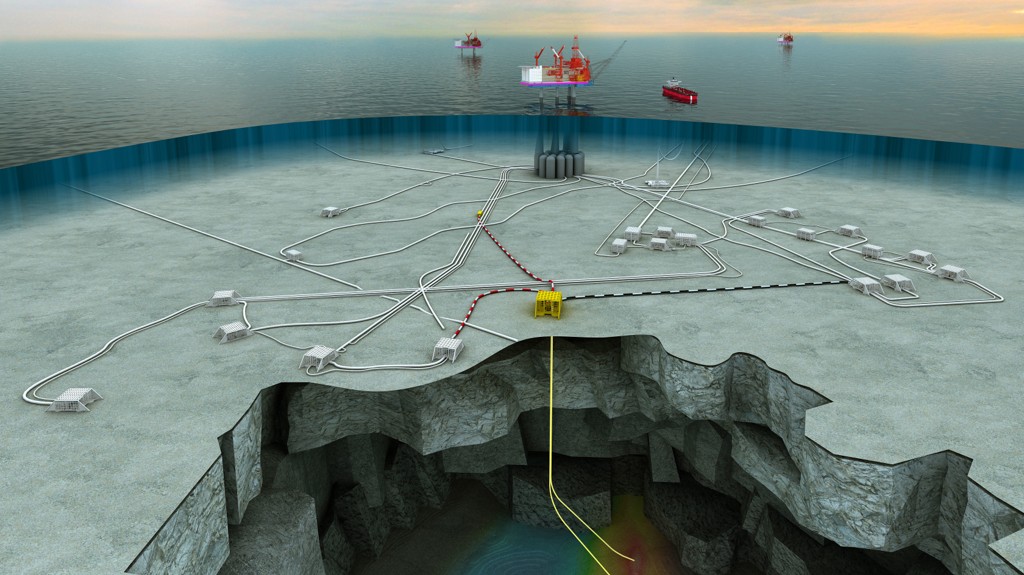

Central to the case is a network of companies based in Jersey and the British virgin islands, companies prosecutors believe Larsen controls through intermediaries.

In recent years, the activity of the companies gradually scaled down. Big assets are paid out to shareholders, including Larsen. The companies have direct and indirect stakes in a number of companies in the oil and gas industry. The reason for the downsizing is adverse effects of the investigation, according to Larsen.

In an interview with DN in before summer he pointed out problems with the financing of projects and the confidence of foreign investors as a result of the case.

– It has been difficult for me and my conducting business since February 2006 due to this trial, said Larsen told newspaper Dagens Næringsliv in June.

Larsen would then wait until after the trial to comment further.

$ 51 million, or over 400 million, has in recent years paid out by the companies. Over $ 20 million has been paid out since the judgment in autumn 2013.

Strides on yields

Million amounts are paid out to Berge G. Larsen and shareholders who prosecutors believe are straw men for Larsen. Almost all the shareholders are close foreign partners of Larsen for years, with the exception of an American study girlfriend.

– The yields are the answer to who had ownership interests. It shows that Berge G. Larsen does not own more than its registered shareholding in foreign companies. The main problem in this case appears to be that the Tax Administration no later than May 2004 locked into a reality that Berge G. Larsen owned two major foreign companies fully. 12 years of investigation and 200,000 document pages later coves they are not a millimeter from the perception of reality. We believe it demonstrates an extreme degree of tunnel vision and unwillingness to put up with the realities appearing, said Anders Brosveet, head Larsens defending team.

The prosecution was of a different opinion, and pointed that yields first started after Larsen was aware that he was under investigation.

Larsen has recently announced major claims against the state and has reduced its investigation of the authorities’ conduct in this and other cases.

Background: Larsen investigates investigators

It is 11 years ago the police in Bergen started investigation of Larsen after review by the IRS.

See also: PSA worried rapid downsizing

oil Fund shopper in San Francisco

oil discovery for Rokke oil company

Norway slams, but growth surprises

See DN special: Oil crisis. Is it over?

Everything about oil ONS 2016

Follow the market with DN Investor