It’s not often the governor is so clear about the risk of financial imbalance.

– We are become more concerned because the rise in debt has increased, and not least that house prices continue to rise sharply, says governor Øystein Olsen to the E24.

He believes the central bank has had regard to the housing market with them all the time, but says that there are signs that financial imbalances are now starting to build up.

– Boligprisveksten has continued to rise until quite recently, and is very high on a national basis, and especially high in urban areas, not least in Oslo, he adds.

Olsen says that he doesn’t want to scare people, and that Norges Bank believes house prices will continue to increase, but at somewhat slower pace.

– I will not dramatize the situation in any way, ” says Olsen.

– We draw a picture where things are going well. Pretty good, ” he says.

Increased risk

the central Bank keeps the interest rate unchanged in December, and refrain from cutting, among other things because of high house prices. In its monetary policy report yesterday, the central bank is longer than in the past to warn against boligprisgaloppen, which has accelerated in the last period.

– The strong growth in house prices and household debt have increased the risk of an abrupt decline in demand forward in time, write the Norges Bank in the report.

Norges Bank keeps interest rate unchanged

the Risk for imbalances netting thus a number of factors which speaks in favour of cutting interest rates, among other things, that it will take longer time before the activity in the economy increases than previously estimated, that difference has increased between the sentralbankrenten and the interest rate their banks to lend to each other, and that the crown is stronger than expected.

– Is more concerned about

– the Reason why rentebanen is little changed is that Norges Bank is now even more concerned about financial imbalances and risks in the Norwegian economy. It will contribute to lift rentebanen by 0.25 percentage points, ” says chief economist Jørgen Gudmundsson in Sparebanken Vest.

There is still a greater chance of a rate cuts than an increase in interest rates next year, but Norges Bank fears that the debt growth to continue gaining momentum if it cuts the interest rate further now.

– the Risk for the buildup of financial imbalances and uncertainty about the implications of a lower key policy rate now speak to go carefully forward in the rentesettingen, writes the bank in its December report.

LESS SPEED: Governor Øystein Olsen wants to reduce the growth in the housing market, and says that he’s become more concerned than in the past, but that he does not want to dramatize the situation.

strict requirements

Both the central bank and government are concerned about the development in house prices and debt.

After the advice from Norges Bank put the government on Thursday up banks ‘ capital requirements to make them more robust in case of financial imbalance, by increasing the so-called “contrarian kapitalbufferen” to 2 per cent from 1.5 per cent.

New monetary policy report: Powerful nedrevidering in the oil projections for 2017

It happens the day after the government established a new boliglånsforskrift as tightening banks ‘ ability to provide loans in Oslo’s red-hot market, and puts more restrictions on låneopptaket throughout the country.

– The measures, not least with the measures we suggest above and advise about, are reasonable and appropriate, ” says Olsen, who says time will tell whether these measures will curb inflation in the housing market.

– Even a little bit higher capital ratios in the banks will be able to make banks more robust so that they are prepared to endure the possible downturn that we are visiting. The measures come around boliglånsforskriften will be able to have a certain dampening effect on borrowing, especially among the vulnerable groups among the households, ” he says.

– Authorities are on the offensive

– It is clear that the authorities are on the offensive in regards to financial stability, says the chief economist Shakeb Syed in Sparebank1 Markets.

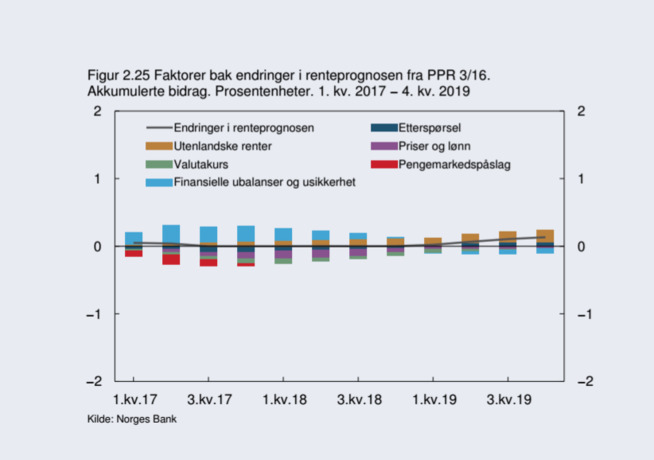

NEW POST: the Figure illustrates the factors that determine the rentesettingen. The blue bar shows the financial stability and uncertainty, and is posted by the central bank in particular to emphasize the concern for the housing market, and to explain why the interest rate not being cut more now.

Sjeføkonomen points out that the central bank has introduced financial stability and uncertainty as a new column in the figure it uses to illustrate the factors that determine the rentesettingen (see figure).

– In addition to this new column in the renteregnskapet, we can in the same breath mention yesterday’s news about the 40 per cent equity with the purchase of second homes in Oslo as well as a gjeldstak of five times income, ” he says.

Still does not use the central bank the word “bubble”, but emphasises that many households are vulnerable, which can increase the chance of loss in the banks. Level of household debt rising faster than incomes, house prices are rising, and prices of commercial property have also risen sharply.

No comments:

Post a Comment