the Case is updated.

Forecasts and exit polls pointing to an overwhelming victory for the no side. Different measurements show a support level of between 54 and 61 per cent for those who want to preserve the constitution as it is.

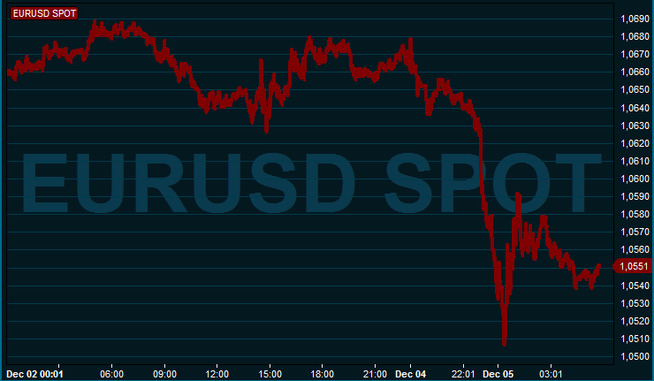

Measurements have been made that the euro has depreciated sharply against the dollar and fell to its lowest level in 20 months.

Not since march 2015 has the euro been so weak against the dollar.

Update! this Monday morning the euro picked up slightly again (see graph), but is still greatly weakened since the Sunday before the election results became clear. A euro costs now 1,055 dollars, compared to around 1,067 Sunday.

A euro costs now 8,945 Norwegian krone.

resigns as prime minister

Renzi has staked everything on a card and notified tidligre that he would go off if neisiden prevail.

From the pulpit in Rome on the night of Monday underlined Renzi that he takes full responsibility, and that only he – and no other – that has lost.

– this is my reign is over. When you lose, you can not pretend that nothing has happened. Long live Italy. I believe in Italy, and I believe in democracy.

It has created turmoil in the markets and set in motion a discussion about what awaits Italy in the time ahead. A scenario is that the Renzis departure should lead to a speedy new elections, which paves the way for that Femstjernersbevegelsen, led by Beppe Grillo, can take to the parliament palace in Rome.

the Party has built its support level of resistance against eurosamarbeidet, that more fear should be put on the game.

Continue anyway?

But others believe that an equally likely scenario is that Renzi continues as prime minister or that it is inserted into a temporary government. This will have the responsibility to make changes in the election that was adopted in the summer, and that depends on a yes in the referendum for it to function.

(the Article continues below the image.)

POWERFUL EURO-CASE: To move the euro up against the dollar after valgdagsmålingene was published at 23 on Sunday evening. The graph shows the evolution forward to the clock 05.48 Monday morning.

A yes would have undoubtedly strengthened Renzis position against a new election by may 2018. It would also pave the way for new economic reforms in a country still struggling with an enormous debt burdens.

the Goal of the grunnlovsreformen was to give the government greater ability to implement measures to get the Italian economy on the right track.

It should mainly be done through two steps: To limit the senate’s influence over Italian politics and the transfer of power from the regions to the government.

Borders the banking sector

Valgoppslutningen has been high. At the 19-time Sunday reported the country’s interior ministry that 57,5 percent of the country’s voting population had cast vote.

Italy’s gjeldsberg: – Build up a pressure

There are more than the two previous referendums on grunnlovsendringer in Italy.

The Italian banks are in a deep crisis and need much fresh capital. The yes side has argued that a no will make it more difficult to get investors, because it sends signals that the italians are not reformvillige.

in Total, Italian banks lending which is not being operated on an estimated 360 billion euro and the market expects that the real value of these loans only a few tens of per cent.

Reformmotstanderne fear, however, that a reversal of the current political system, should give the prime minister too much power.

Italy is holding a referendum about prime minister Matteo Renzis grunnlovsreform.

the Reform is mainly about two things:

- For the first it should limit the senate’s influence. The number of senators should be reduced from 315 to 100. Senators should no longer be selected, but be mayors and members of regional authorities. In most cases these will only have an advisory role, where today they have as much influence as the members of the house of commons. This will make the political system more dynamic.

- For the other will reform to transfer power from the country’s 20 regions to the governmental authorities in Rome. The goal is that this will limit spending and provide less bureaucracy.

the Proposals are linked to a new valglov, Italicum, which was implemented in the summer. This gives the party receiving the most support in an election, additional seats in the house of commons in the parliament to ensure a styringsdyktig the plural.

If grunnlovsreformen fall, it is expected that this will be changed.

(Source: Financial Times)

No comments:

Post a Comment