on Thursday decided Norges Bank to keep the key rate unchanged and signaled that it will likely remain at 0.5 per cent for a long time to come.

The record-low key interest rate is seen as one of the main reasons that house prices have galloppert the last few months.

In his pengepolitikse report emphasizes the Norges Bank that inflation is a sign that the so-called “financial imbalances” that have built up in the Norwegian economy.

– We are just as concerned as any other, perhaps more concerned about also, for a recoil in house prices, says governor Øystein Olsen to the E24.

– the Drop increases the higher house prices will come, and a case will not only frame individual, but the entire economy, ” he says.

also Read: This means the interest rate decision for your wallet

Take account of inflation

The low interest rates makes that norwegians take larger mortgages, which makes them more susceptible to increased interest rates, a fall in house prices and inntektsbortfall. It increases the risk of an abrupt decline in the consumption something forward in time.

According to the central bank makes henynet to “financial imbalances” that the forecast for the key policy rate is somewhat higher than it otherwise would have done.

At the press conference after interest rate decision was Olsen questions whether the further rise in house prices alone may be enough to Norges Bank turns up again the interest rate.

I can’t answer bombastic on, in addition to remind that the purpose and styringsmålet our is low and stable inflation, ” he says.

chief economist of Swedbank: – Confirms that we are out of oljenedturen

– When inflasjonsutsiktene is well rooted, so we will also take into account the development in production and employment, and in times like this, among other things, to support the restructuring of the Norwegian economy.

at the same time he stresses that the central bank is aware that the low interest rate is an important driver of higher lånopptak and thus also higher house prices.

– And in that sense we try to take into account the so far the situation allows it. But the goal of monetary policy can not be to control the housing market, points out sentralbanskjefen.

– No bubble

Carl O. Geving in the Norwegian real estate agents (NEF) was very pleased when it became clear that Norges Bank will not touch interest rate and at the same time far on the way avblåser future cuts.

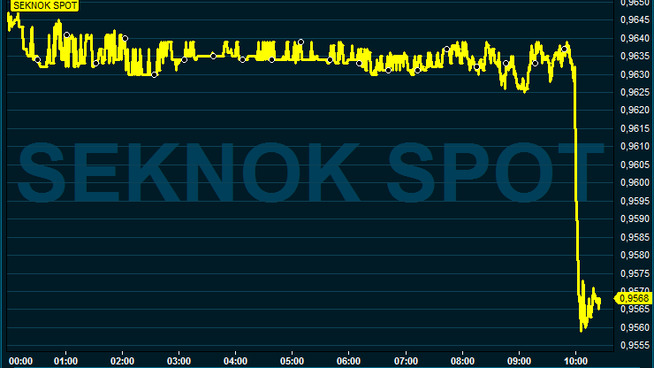

Powerful kronestyrkelse

– To tamper with the base rate now, had been risky. It should in any case not longer down. Then you could have been confident that house prices in pressområder had been the lighthouse up further, ” said director Carl O. Geving to the E24 just after the decision was known.

Since the last trough in June, Norges Bank revised up its forecast for house prices going forward. Growth is projected to remain high in the coming months, then decrease.

In Oslo, the price increase of 16 per cent (over twelve months), but Olsen does not want to call the situation in the capital city is a bubble.

– We do not use the term, because we believe it is fully possible to explain boligprisutviklingen, ” he says.

– Boblebegrepet give associations to the situation in Spain a few years ago, where they had a huge residential construction. When house prices fell, stood the 100,000 homes empty, and it is a piece from the situasjonnen we have in Norway today.

No comments:

Post a Comment