The last few years, the world has been in an unfamiliar situation: the market has been flooded by cheap oil. Prices have fallen from record levels of over usd 100 per barrel two years ago, and now trading at around half.

But this can have consequences, and now warns the international energy agency that two years with dramatically reduced investments in new projects may lead to a skvis in the markets.

If this continues in 2017, there is a risk of tilbudsskvis towards the end of this decade or in the beginning of the 2020′s, ” says Tim Gould, one of the hovedforfatterne of this year’s edition of the World Energy Outlook.

Cut investments

oil Companies have in fact cut investments drastically, the pressure of low prices and growing debt. Last year was the volumes that were approved for development so low that we have to return to the 1950s to find something similar, according to the IEA.

a FEW DEVELOPMENTS: This is an overview of the conventional oil resources that have been approved for development globally between 1960 and 2015, in billion barrels, according to the energy agency.

– In an average year between 2000 and 2014, it was resolved decisions (about the developments) of around 15 billion barrels. But in 2015 dropped that number to around six billion barrels of oil, or a drop of two-thirds, ” says Gould.

– you Look at the data for 2016 you will see that there are no signs of an upturn, he adds.

Norwegian oil companies follow the same trend as the other international oil companies: Statoil cut recently its expected investments of 11 billion dollars in the year, from a peak of around 20 billion dollars in 2014. A number of projects are deferred because the company will improve the economy.

compensate

Fewer investment decisions allows produksjonsfallet in existing fields becomes clearer. The IEA estimates that production from existing oilfields to fall an average of 6.2 percent annually after the field is over produksjonstoppen, which means that the world loses oil at the level of one Iraq every other year.

– This is important because this is the projects that will replace the decline in conventional oil production, which accounts for 70 per cent of the overall production, ” says Gould.

If the oil companies adopts projects with around six billion barrels in the next year, they will need to adopt projects with 21 billion barrels each year between 2018 and 2025 in order to avoid that global production falls, estimates the IEA. Such levels not seen since the 1970s. (page 164)

It is 70 years since there was found little oil in a year

The annual WEO report is an important source of information about the energy markets, which are frequently used both by Norway and the other OECD-countries in the planning of energy policy as well as in the public debate on developments within the oil, gas, coal, nuclear and renewable energy.

According to the IEA, there must, on average, invested more than 1800 billion dollars in energy until 2040 to be able to supply the market. Of this, 20 per cent going to renewable energy and 60 per cent to the oil, gas and coal production as well as fossil power plants.

the united STATES may increase the

An important factor behind the global overproduction of oil is a sharp increase in U.s. oil shale production, or “tight oil”.

the IEA believes the united STATES to a certain extent, may counteract the decline in production elsewhere, but is concerned about the sustainability of the longer-term, since u.s. companies have drilled the best areas.

– shale oil may play a role in counteracting sudden price increases, but one should not rely on that it can counteract a large fall in supply, ” says Gould.

the IEA have revised upwards the expected production in the united STATES, but says that the overall production outside of OPEC is expected to fall from early in the 2020′s.

IEA: Renewable larger than coal

Must rely on Iran

Thus need the oil market to rely on countries like Iran and Iraq can deliver the oil as required, according to the IEA. The middle east’s market share is expected to increase to over 50 per cent in 2040, says the agency.

Iran is expected to increase its production to six million barrels per day in the period from 3.6 million barrels per day in the last year, while Iraq is expected to reach seven million barrels a day from 4.1 million barrels per day last year, ” says the IEA.

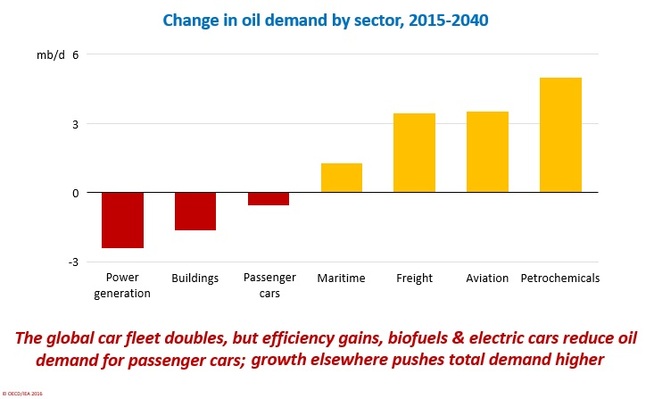

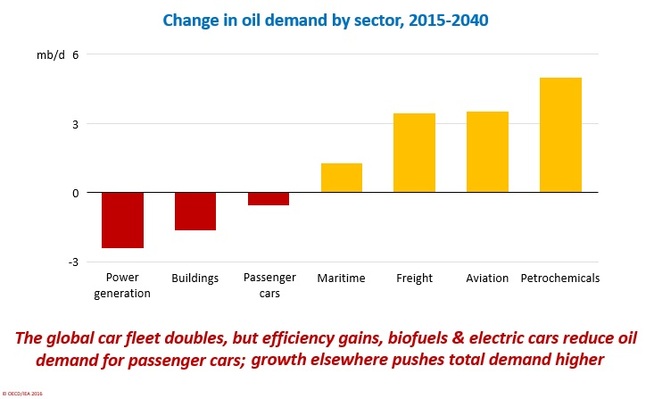

at the same time is expected in both the united STATES and the EUROPEAN union to reduce its oljeimport, aided by energy efficiency and the transition to electric cars. The united STATES will probably just import a million barrels per day in 2040, compared to around five million barrels per day in the last year, according to the IEA.

India and China will thus be the world’s largest oljeimportører in 2040.

No comments:

Post a Comment