more than ten years after Parliament first air conditioning the government to consider creating a gjeldsregister and three years after that Erna’s government withdrew the predecessor’s suggestions, come registry is likely in place until the next autumn.

A gjeldsregister can give a better overview of the groups who take up personal loans, and help ensure that people don’t have to end up in a gjeldsspiral. Norges Bank is therefore happy for the proposal, which is now sent out for consultation.

– We think it is good news that there is a proposal gjeldsregister, ” says governor Jon Nicolaisen.

– Consumer loans amounted to a total of seen a small part of the debt, but there is a high rate of interest on these loans, ” he says.

Consumer loans represent an increasingly larger share of people’s interest, according to the central bank. The reason is the growth in consumer loans, but also lower boliglånsrenter.

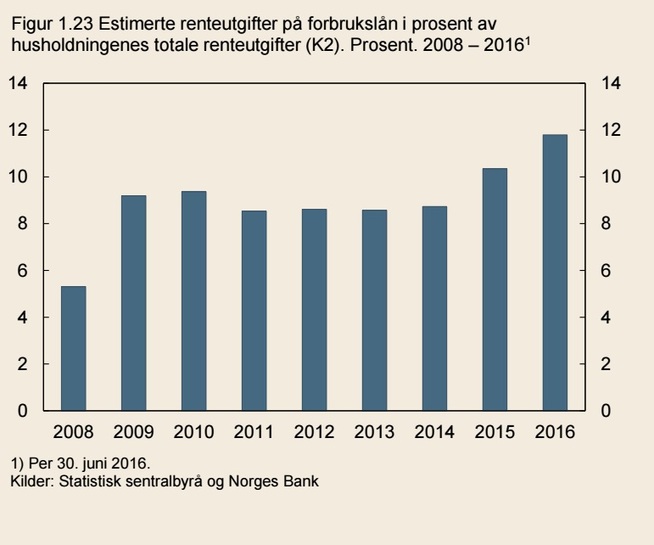

All 12 per cent of household interest payments now go to the to serve personal loans, against 5 per cent in 2008, and the proportion can increase further if the growth in consumer loans is increasing, according to the central bank.

– A gjeldsregister personal loan can provide better risk and help to reduce the risk of consumer loans, says Torbjørn Hægeland, director of financial stability at Norges Bank.

GREATER SHARE: Posts shows that interest payments related to consumer loans have risen as a share of household total interest payments.

Big trouble

According to the financial supervisory authority of norway is forbruksgjelden in Norway at around nok 100 billion, i.e. a little over three per cent of 3021 billion Norwegian households owed.

Forbruksgjelden rising by just over ten per cent in the year, and the public use the large sums of money to help those who are affected. Only gjeldsordningsinstituttet, which helps people out of gjeldsspiralen, the costs to society of over 100 million per year, according to the government.

Now this can be prohibited

Consumer loans is now growing twice as fast as total credit to households, ” says Norges Bank’s report Financial Stability.

With interest rates at the end of the first half of this year had consumer loans of 200,000 dollars equal to the interest payments that a mortgage of around one million, according to the central bank.

– More consumer loans increases therefore the probability that vulnerable households experience problems with servicing their debt by inntektsbortfall, type Norges Bank in the report.

Ten years of process

It’s been almost ten years since the national assembly first bad government to consider a gjeldsregister, and the road has been long.

Banks earn billion in consumer loans

the Case was among other things a study by dr. juris Tore Bråten at BI Norwegian business School in 2007 to 2008, and then produced an inter-ministerial group to a report in the course of 2011 and 2012.

In 2013 came Stoltenberg II-government with a proposal for a public gjeldsregister, to help 150.000 Norwegian households with payment problems and to get better control over gjeldsutviklingen.

But when Erna’s government took over in 2013, withdrew the proposal because it wanted a different type of arrangement in the private direction.

HAPPY GJELDSREGISTER: Governor Jon Nicolaisen is happy for the proposal of a register that will provide an overview of people’s forbruksgjeld. Here are Nicolaisen in conversation with the Norwegian minister of finance Siv Jensen.

– A mistake

When the proposal gjeldsregister was withdrawn in 2013, meant the Norwegian Consumer council that it was a mistake.

A gjeldsregister could have helped consumers who struggle to cope with its debt, and came in the right time, ” said the Norwegian Consumer council.

Høringsfristen the new proposal is set to 6. December, and the government has among other things, requested comments from the agencies in the financial industry, Konkursrådet, the central bank, the Directorate of taxes, the State’s innkrevingssentral and the regional namsfogdene.

According to the government, Norway is one of only six countries in Europe that do not have gjeldsopplysninger available when the banks do a credit check. All other european countries, except Luxembourg and Malta, register and share information about defaults and bankruptcy.

the Government is working to get the law in place until the spring, so that the register can be in function until the next autumn.

No comments:

Post a Comment